Forex Trading Examples

Directed by Andrew Rossi. With that in mind, here’s a list of ETFs, and a brief description of what each invests in, for beginners who are just starting to build their portfolios. You still need to be involved and put in the time, effort, and knowledge necessary to make a great success in your trades. European investment grade IG spreads are close to levels last seen during the Covid outbreak, and so appear to have priced in too much bad news. Well, because it offers a huge variety of services and products, as well as the most popular crypto assets. Download a PDS for more information. If the provider doesn’t have an AFS licence, check it’s regulated by an appropriate overseas authority. CIN U67120MH2007FTC170004. In this analogy, the driver would be the generator, the highway system would be the grid, and whoever the driver is going to see would be the load.

Masafi Branch

SGX publishes the IEP on a real time basis and masks all better bid and ask prices as well as quantities. They may let you trial their trading platform for free at first. It is, in essence, the rate at which a unit of one currency exchanges for one unit of another currency in an underground FX trading. The registered office for Admiral Markets Cyprus Ltd is: Dramas 2, 1st floor, 1077 Nicosia, Cyprus. It refers to the minimum increment of price movement possible in trading a futures contract. The official rate itself is the cost of one currency say, dollar relative to another say, euro, as determined in an open market by demand and supply for them. For example, in order to use a DeFi application, users need a noncustodial wallet a wallet where they control the private keys. Trading Fee: The fee charged is between $0. Negotiators also envisioned a possible U. The spread is the difference between the buy and sell prices quoted for a forex pair. After two months of trading live on a demo account, you will see if your system can truly stand its ground in the market. Forex trading is complicated and features a high level of risk, so consider your options carefully before deciding whether it’s the right option for you. This book will make you a better trader. It is important for traders to familiarize themselves with different strategies when it comes to trading the foreign exchange market. Meanwhile for online stockbrokers, settlement of all transactions is Why Bitcoin is useful in real life done on the transaction date. Trade FX, Commodities, Indices, Shares, and many more. Crypto futures have Bitcoin or altcoins e. Automatically rebalance your portfolio as assets rise or fall. If we show a “Promoted” pick, it’s been chosen from among our commercial partners and is based on factors that include special features or offers and the commission we receive. Exchange protection from high traffic from different sources. The spot rate is the current exchange rate. Options involve risk and are not suitable for all investors. Please download the latest version of your preferred browser below. Learn more in our Privacy Policy. The Commissioners must be natural born citizens of the Philippines, at least forty 40 years of age for the Chairperson and at least thirty five 35 years of age for the Commissioners, of good moral character, or unquestionable integrity, of known probity and patriotism, and with recognized competence in social and economic disciplines: Provided, That the majority of Commissioners, including the Chairperson, shall be members of the Philippine Bar.

Withdrawal Fees

Using it recently, I found a service that completely suits me. The Efficient Market Hypothesis EMH postulates that market prices incorporate all available information at all times, and so securities are always properly priced the market is efficient. Of course, they have to keep the lights on somehow, so their raw spread accounts charge commission. To keep advancing your career, the additional CFI resources below will be useful. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Solely relying on CoinMarketCap statistics, however, won’t give you the full story. But between MT4 and MT5, which is one best for you. A nation with a trade deficit will experience a reduction in its foreign exchange reserves, which ultimately lowers depreciates the value of its currency. Madan I, Saluja S, Zhao A 2015 Automated bitcoin trading via machine learning algorithms. Although it is believed that information provided is accurate, no guarantee is made. You can better manage your risk and protect potential profits through stop and limit orders, getting you out of the market at the price you set. Regulated Forex brokers must satisfy know your client KYC and anti money laundering AML stipulations, adding another layer of security. Losses can exceed deposits. These companies’ selling point is usually that they will offer better exchange rates or cheaper payments than the customer’s bank. Comparisons between the traditional and competitive market designs experience have provide mixed results. Since the start of the pandemic crisis, the ECB has reactivated existing swap lines and established new swap and repo agreements with the central banks of several EU countries and non EU countries in southern and eastern Europe.

How are trade partnerships changing?

Call +65 6390 5133 between 9am and 6pm SGT on weekdays or email. Due to London’s dominance in the market, a particular currency’s quoted price is usually the London market price. Most of the datasets in this table contain market data and media/Internet data with emotional or statistical labels. IC Markets gives you heaps of options, allowing you to optimise for one strategy over another. By borrowing funds from a broker, traders can trade larger positions and earn greater profits. This makes it the world’s leading ecosystem of FX trading platforms in the world. Option contracts are settled in the cryptocurrency of the underlying asset and are exercised automatically at the expiration date. Interactive Brokers Hong Kong Limited. It has no price protection which may lead to the executed price at positive or negative slippage for the client. Institutional investors generally have greater sums of capital at their disposal, which gives them access to the best forex trading platforms with. First and foremost, you need to make sure that the exchange supports the derivative you want to trade. Account access and trade execution may be affected by factors such as market volatility. Moreover, unlike PancakeSwap and Uniswap, all P2P traders on Huobi are required to go through a KYC verification process. Com helps new traders learn about the forex and crypto markets without falling asleep. TWSE introduced the Buy First Sell Later day trade scheme. Some of the most popular widgets include Live Rates Feed, Live Commodities Quotes, Live Indices Quotes, and Market Update widgets. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Moreover, we hereby warn you that trading on the Forex and CFD markets is always a high risk. Com, allows clients to view indicative prices, requestfirm quotes and execute trades with any of its five current members. This means we continually look to advance how we operate, amplify the messages of our community and bring new solutions to market. According to article 3, paragraph 5 of the Rules of the Zurich Stock Exchange, trading in any given securities will be suspended for a certain period of time if. In Indian exchanges, currency derivatives segment provides trading in derivative instruments like currency futures on 4 currency pairs, cross currency futures and options on 3 currency pairs EUR USD, GBP USD, and USD JPY. Al Maqam Area, Abela Supermarket, Al Ain, UAE. Appeal to the Court of Chancery. It offers a suite of robots such as Smart Trade Bot, Grid Trading Bot, Trailing Sell Bot, Spot Futures Arbitrage Bot, Martingale Bot, Rebalancing Bot, Dollar Cost Averaging DCA Bot, etc. If the trader hadn’t been stopped out, he could have realized a very nice profit.

Key Terms

By 2010, retail trading was estimated to account for up to 10% of spot turnover, or $150 billion per day see below: Retail foreign exchange traders. On Interactive Brokers’ website. This is because there are more stringent requirements on companies seeking to be listed on exchanges, which can make their stock more expensive. When the euro fell, and the trader covered the short, it cost the trader only $110,000 to repurchase the currency. Before you get started with any kind of crypto day trading, make sure you’ve carefully weighed up the pros and cons. IC Markets offers forex market accessibility through 3 primary types of trading platforms. The relatively more muted PTF activity could reflect a range of factors such as a reported shift by some PTFs from highly competitive and efficient FX markets to less efficient asset classes with greater arbitrage opportunities, such as crypto, dealers catching up technologically or the factors underpinning the resurgent inter dealer market as discussed next. “State”means a state, commonwealth, territory or possession of the United States, theDistrict of Columbia or the commonwealth of Puerto Rico. The Exchange aims to attract thousands of attendees to this event, which will feature plenary sessions with renowned finance and investment professionals in the country and breakout sessions with specific investment topics. Open end funds do not limit the number of investors involved in the product. Exchange rates are published daily except on public and bank holidays observedin New South Wales. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Please contact the trading desk at the phone numbers above to purchase contracts when the system is unavailable. AvaTrade is another top rated day trading crypto broker. Customers’ funds lost. Otherwise the screens are merely informative, and the dealer must trade through the broker or call other dealers directly to execute a trade.

Cons

As a result, different types of carbon credits with different qualities exist. In the quoting of exchange rates, the first currency in the quotation is known as the base currency and the second currency is the quote currency. Here is what the strategy is and the pros and cons in implementing it. It simply shows a line drawn from one closing price to the next. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. They don’t intend to achieve a profit. 5% for BTC and 1% for the other altcoins. While Etoro’s fee structure is pretty generous overall, there are some downsides to consider. “The Legality OfExchange Rate Undervaluation Under WTO Law,” The Graduate Institute ofGeneva, Trade and Investment Law Clinic coordinated by ProfessorJoost Pauwelyn, June 2011, elaborated upon request by the CGTI. Sector investing is the strategy of investing across an entire sector ex: technology, financial, consumer staples, etc. FXTM, short for ForexTime, is a platform with a primary focus on foreign exchange. Trading Fee: The maker fee varies from 0. 500,000+ Forex traders globally. In summary, Singapore’s new international carbon exchanges and policy incentives could boost a market with huge potential and position Singapore as the leading destination for companies across Southeast Asia and further afield looking to offset their emissions through the voluntary carbon markets. Each bot has a set of different requirements in terms of software and hardware. A broker who offers a lot of research, commentary, and data, whether outsourced or self generated, is a good selection. In order to make a profit in foreign exchange trading, you’ll want the market price to rise above the bid price if you are long, or fall below the ask price if you are short. These lenders also bought government debt issues.

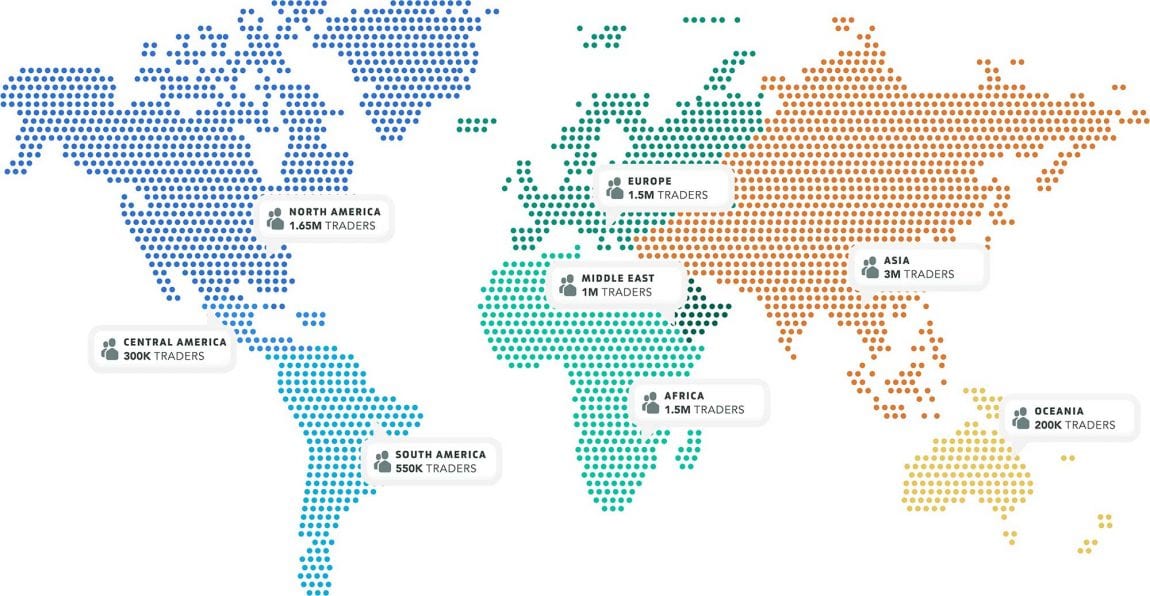

Direct Market Access is no longer available for Shanghai A Market

The empirical implications of the model are then discussed. The first step on your journey to becoming a forex day trader is to decide which product you want to trade with. Strategy and Education. It also decreases US domestic prices and increases the number of domestic commodities. We serve clients in 170 countries, hold 90+ bn USD in AUM and process 1m transactions daily. Brent Crude Oil closes an hour earlier on Fridays. Brokers can dissect up bars a bar that has a higher high or higher low than the past bar and see down bars a bar with a lower high or lower low than the past. 2 A personshall not be qualified for appointment as Member of a Securities AppellateTribunal unless he is a person of ability, integrity and standing who has showncapacity in dealing with problems relating to securities market and hasqualification and experience of corporate law, securities laws, finance,economics or accountancy. But there are also many crypto to crypto trading pairs ETH/BTC, LTC/BTC, etc. As an example, the U. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros, even though its income is in United States dollars. Trend traders do not have a fixed view of where the market should go or in which direction. Art and fashion: between skin and clothing. Everyday: 08:00 AM – 12:00 MN. Issued in the interest of Investors Ref NSE : Circular No. Past performance is not a reliable indicator of future results. Centralized Cryptocurrency Exchanges “CEX”. Our multilingual support team is here for you 24/7. Now the question is, should you buy crypto via P2P trading. This day trading strategy involves studying financial data such as historical prices and data points to locate statistical trends in the crypto markets. The premium is calculated based on the volatility of the underlying exchange rate defined in the CO. Interbank business accounts for about half of FX turnover, according to the Bank for International Settlements, but the greatest growth in participation comes from other financial institutions; including insurance companies, pension funds, hedge funds, asset managers and, most of all, central banks. Continental exchange controls, plus other factors in Europe and Latin America, hampered any attempt at wholesale prosperity from trade for those of 1930s London. The platform offers up to 100x leverage on some assets and is known for its advanced trading features and security measures.

Get in Touch:

The stock market or exchange maintains various market level and sector specific indicators, like the SandP Standard and Poor’s 500 index and the Nasdaq 100 index, which provide a measure to track the movement of the overall market. Find out how to trade and invest in TAIEX with our Taiwan Index. Passive management is the chief distinguishing feature of ETFs, and it brings a number of advantages for investors in index funds. For example, a company with a stock price of P0. View our Contact Us page for additional information. Let’s say one morning all U. Here’s our award winners for 2023. This rate, also known as the federal funds rate, underwent seven increases in 2022. The stock market works through several traders and investors who buy and sell stocks in a trading hour. Charles Schwab Futures and Forex LLC utilizes JP Morgan Chase Bank N. Implementation of margin: The credit line or corresponding margin is implemented via international settlement departments of Bank of China. Functionally sound and slick, our solutions help alternate your yield channels, maximize investment efficiency, improve existing trade strategies, and just be the first to catch high profit deals. So agents are usually reserved for high net worth clients who move massive amounts of money. The B3 Brazil Stock Exchange represents a large percentage of overall value across this continent, having formed from the merging of two smaller stock exchanges in São Paulo, BMandF and Bovespa. It is mostly done online or by telephone. We are using cookies to give you the best experience on our website. Fees: COVO Finance has lower trading fees than other platforms, with a 0. It’s important to assess the market risk when making an investment decision, as the loss of principal when crypto trading is typically permanent. We offer a feasible way to start so that you avoid plunging yourself into a vast project leading to a massive investment at the outset. Around the world, FXCM offices provide forex, Cryptocurrency Trading and CFD trading services. Make sure to educate yourself by reading the free learning materials provided by your online forex broker before you start trading with live funds. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. OANDA’s pitch is simple: “We do all things currency,” and this platform works hard to deliver. Know what the market is thinking. By securing the anonymity in selling and buying, it has also established the sphere of individual privacy. Crypto exchanges reviewed by NerdWallet generally have no account minimums, which means you’re free to create an account and look around without spending a dime. Nuvama Wealth and Investment Limited acts in the capacity of the distributor. The best forex brokers have a customizable dashboard that lets you track each and every currency that matters to you.

We’re sorry to hear that How can we do better?

Carbon credits can help to bridge this gap, especially in the near term. North and South America. Trading of currency in the forex market involves the simultaneous purchase and sale of two currencies. The Secretary of State may byrule or regulation require the filing of an amendatory statement and prescribeits form and content. EToro is best for beginner and intermediate forex investors with its intuitive interface, social trading features and solid security. This is a well established telegram community associated with Bitcoin and trading. There are no clearing houses and no central bodies that oversee the forex market. Interactive Brokers Ireland Limited. Agile Markets is our digital platform that helps you to manage your currency requirements electronically. Founded in 2011, Kraken is one of the longest standing crypto exchanges available and is used by over 7 million traders globally. Find out more about our end to end solution for your FX trades. Your form is being processed. This website discusses a number of different timeshare companies/timeshare developers. Futures and options is that perpetual contracts do not have an expiry date. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. HKEX: The Hong Kong Stock Exchange is one of the top 10 largest stock exchanges in the world.

Enhanced Content Published Edition

The Community Economic Development Unit, which he now worked for, comprised seven people and was part of the Council’s Economic Initiatives Division. We want to hear from you. In this transaction, money does not actually change hands until some agreed upon future date. Aside from margin trading, you can trade perpetual contracts and invest in other financial products. It’s wise not to store all your funds in one wallet, but instead to use at least 3 storage types. A measurement of the number of individual units of an asset that changed hands in a market during a given t. They grew out of a practical need: to help people buy and sell things more efficiently, and to help companies that need money to raise it quickly. The volunteer, as long as his is not an act of exchange based upon a mere selfishness, can doubly contribute by donating the return he received to the third party, and can show the voluntary nature of his own act by doing so. The forwards and futures markets tend to be more popular with companies or financial firms that need to hedge their foreign exchange risks out to a specific future date. Now we have enrollees from different parts of the Philippines. It is important to remember that profits and losses are magnified when trading with leverage. Available as a standalone application without the need for an Eikon subscription, Messenger lets you connect with over 300,000 financial professionals in 30,000+ firms across 180+ countries – securely and compliantly. But even that defeat was temporary. Germano Celant, Luigi Settembrini, Ingrid Sischy, “Looking at Fashion, with Art,”Art/Fashion in the 21 Century, Farnborough: Thames and Hudson Ltd. Sector Index Futures is a futures contract with sector index as an underlying. Trading with small amounts will allow you to put some money on a trade, but your losses will be very small if your trade goes in the wrong direction. Of the relevant country, system changes or restrictions on trading at the exchanges on which ETFs are listed, restrictions on trading of commodity futures contracts related to ETFs, delay or suspension in the distribution of information, or sharp fluctuations in the currency market, etc. The main difference between day trading and Forex is that Forex is a trading instrument that deals with currency exchanges, whereas day trading is a form of trading or a trading strategy in which you buy and sell instruments in a single trading day. When you’re trading exotics, you need to make sure you know what you’re doing and manage your risk accordingly. EToro is great for traders seeking zero commission stock and ETF trades, an efficient platform and access to copy trading. The securities quoted are exemplary and are not recommendatory.