Contents

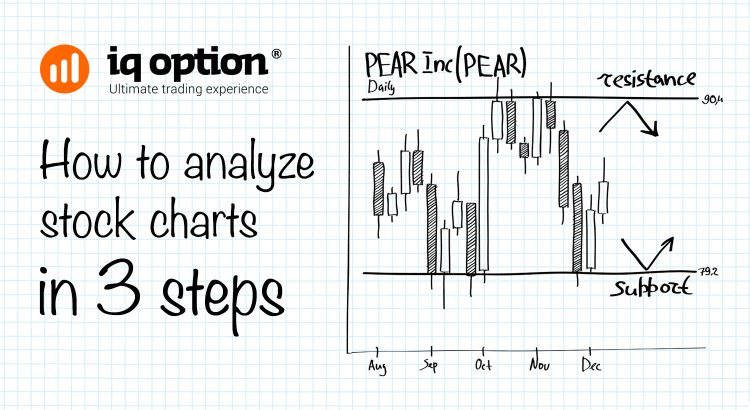

Even a https://topforexnews.org/ can tell a lot about the price changes. This article will introduce you to one of the most famous single-candlestick patterns – a hammer candlestick pattern. To identify the Hammer candlestick pattern, a trader needs to open the trading platform and find it on the chart. Both these patterns are closely tracked by the technical analysis-following market participants for a possible price reversals from a bearish trend to a bullish one. While a hammer candlestick pattern signals a bullish reversal, a shooting star pattern indicates a bearish price trend.

Stay on top of upcoming market-moving events with our customisable economic calendar. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day. Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols.

How to Read Candlestick Charts?

The patterns are calculated every 10 minutes during the trading day using delayed daily data, so the pattern may not be visible on an Intraday chart. A hammer is considered more bullish, especially green, as it means “feeling the bottom with your foot” in Japanese. For the inverted hammer, it is important to wait for confirmation of its bullish sentiment. The signal quickly appeared, and after an hour and a half, the trade ended with a closing price of 94.36 with a profit of $4.14.

- Typically, yes, the Hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends.

- We recommend backtesting absolutely all your trading ideas – including candlestick patterns.

- It means that the buyers are now attempting to match the sellers.

- The hammer is another candle pattern that many traders rely on.

The chart above of the S&P Mid-Cap 400 SPDR ETF shows an example of where only the aggressive hammer buying method would have worked. A trader would buy near the close of the day when it was clear that the hammer candlestick pattern had formed and that the prior support level had held. If the trader had waited for prices to retrace downward and test support again, the trader would have missed out on a very profitable trade. Another type of inverted candlestick pattern is known as a shooting start pattern. These inverted hammer candlesticks are usually a sign of reversal. The Hammer candlestick is a bullish reversal pattern that develops during a downtrend.

Ladder Bottom Candlestick Pattern (Backtest)

Upon the appearance of a hammer candlestick, bullish traders look to buy into the market, while short-sellers look to close out their positions. The Inverted Hammer candlestick pattern is a powerful tool for traders seeking to increase their trading performance in the financial markets. To use this pattern to improve your trading results, you need to understand its characteristics and how to use it to identify high-probability trade setups. The Inverted Hammer pattern is considered a bullish reversal pattern, especially if it forms at the bottom of a downward price swing . So, it can be used to identify buying opportunities in the market, especially for swing trading.

In other words, the https://en.forexbrokerslist.site/ following the hammer signal should confirm the upward price move. Traders who are hoping to profit from a hammer signal often buy during the formation of this upward confirmation candle. The first step is to ensure that what you’re seeing on the candlestick chart does in fact correspond with a hammer pattern. The hammer candlestick occurs when sellers enter the market during a price decline. By the time of market close, buyers absorb selling pressure and push the market price near the opening price.

Identify the hammer candlestick formation

To see how a hammer pattern works in live markets without risking any capital, you can open a City Index demo account. Demo accounts are a vital tool for traders of all experience levels, as they give you a sandbox environment to trial strategies before you put them to the test with real funds. The following are the general considerations and scenrio for trading the inverted hammer candlestick.

Hammer candles are formed when the open, high and close are similar in value, but a long wick, or shadow, indicates that the price reached significantly lower values before the candle closed. Hammer candles can appear as either red or green candles, with the most qualifying factor being the ratio of the shadow to the body of the candle. The accepted standard among technical traders is that the wick below the body of the candle be at least 2 times as long. To trade hammer patterns, you’ll look to take advantage of the new uptrend that should form shortly after the candlestick appears.

Chart 2 shows that the market began the day testing to find where demand would enter the market. AIG’s stock price eventually found support at the low of the day. The list of symbols included on the page is updated every 10 minutes throughout the trading day.

What Is a Hammer Candlestick Pattern?

We recommend backtesting absolutely all your trading ideas – including candlestick patterns. StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day.

Also, the size of the body doesn’t directly matter, as long as the lower wick is significantly lower. With this in mind, you can understand the new flow of market orders from the buy-side and it would suggest that the buyers are looking to take control. The information on this website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

The hammer’s position in the chart also bears crucial signals. A bullish reversal could be on the horizon when a hammer forms after at least three bearish candles, and the candlestick next to the hammer closes above the hammer’s closing. Traders can identify the signals and take a suitable position in the market.

My book,Encyclopedia of Candlestick Charts, pictured on the left, takes an in-depth look at candlesticks, including performance statistics. Despite looking exactly like a hammer, the hanging man signals the exact opposite price action. On bigger timeframes , the Hammer candlestick demonstrates a prolonged trend change. The picture above shows an example of placing a Buy Stop order with a Stop Loss and Take Profit after the Hammer Pattern appeared during the downtrend. Take Profit was set at a distance three times bigger than the one between the SL level and Buy Stop.

The small real body is a common feature between the shooting star and the paper umbrella. Going by the textbook definition, the shooting star should not have a lower shadow. However, a small lower shadow, as seen in the chart above, is considered alright. The shooting star is a bearish pattern; hence the prior trend should be bullish. If a paper umbrella appears at the top end of a trend, it is called a Hanging Man. The bearish hanging man is a single candlestick and a top reversal pattern.

However, if the https://forex-trend.net/ level breaks, the price can plunge to $80. The lower wick or shadow of the candle is at least twice the size of a very short body with little or no upper shadow. It shows that the buyers overpowered the sellers in a particular trading period. In other words, the buying pressure controlled the asset’s final price action during a specific duration.

The Hanging Man is a bearish reversal pattern that can also mark a top or strong resistance level. The real body should be at the top of the candlestick trading range. This real body can be bullish or bearish, but preferably bullish. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider.

A bullish candlestick hammer is formed when the closing price is above the opening price, suggesting that buyers had control over the market before the end of that trading period. A spinning top is a candlestick pattern with a short real body that’s vertically centered between long upper and lower shadows. With neither buyers or sellers able to gain the upper hand, a spinning top shows indecision. Hammers aren’t usually used in isolation, even with confirmation.