Dad cosigned a personal student loan in my situation this past year, but is incapable of cosign some other mortgage for me this year. How to have the currency I must pay money for college tuition?

Extremely new private figuratively speaking need the borrower to have a good creditworthy cosigner. This may involve more than 90% of brand new personal student loans in order to undergraduate pupils and most 75% of the latest private student education loans to scholar and you will professional college students. But, can you imagine the brand new college student does not have any a beneficial creditworthy cosigner? Just how do a student score figuratively speaking versus a beneficial cosigner?

Government student education loans, such as the Direct Mortgage, Perkins Financing, and you will In addition to Loan  , do not require the newest debtor to have good cosigner. (Should your borrower out-of a plus Financing enjoys a detrimental borrowing from the bank records, the brand new debtor may still meet the requirements if they provides an endorser who would n’t have an adverse credit rating. Brand new endorser is like a cosigner. One other government student loans do not look at the borrower’s borrowing record.)

, do not require the newest debtor to have good cosigner. (Should your borrower out-of a plus Financing enjoys a detrimental borrowing from the bank records, the brand new debtor may still meet the requirements if they provides an endorser who would n’t have an adverse credit rating. Brand new endorser is like a cosigner. One other government student loans do not look at the borrower’s borrowing record.)

Sign up for a keen Edly IBR, No-Cosigner, Income-Built Cost Mortgage

- Need to be an excellent You resident or long lasting resident

- Must be a college junior, university senior, or grad student

- No co-signer requisite

- Get approved within a few minutes. Pre-meet the requirements versus affecting your credit score

- Income-centered cost having situated-during the defenses, such as deferred repayments for many who reduce your job

Edly Beginner IBR Loans are unsecured personal student education loans granted from the FinWise Bank, good Utah chartered industrial financial, user FDIC. All finance is actually at the mercy of qualifications standards and you will review of creditworthiness and you will background. Small print apply.

Money out-of $5,100 – $25,one hundred thousand Analogy: $ten,one hundred thousand IBR Mortgage that have a good seven% revenues percentage percentage getting an elderly college student while making $65,100 per year regarding the life of the borrowed funds. Payments deferred toward first year during the final season regarding knowledge. And, $270 Payment to own 12 months. Up coming $379 Monthly payment having 49 weeks. With one to final commission out of $137 to possess a total of $20,610 reduced over the life of the mortgage.

About any of it analogy: The initial commission plan is set on acquiring last conditions and through to verification by the school of loan amount. You can even pay this financing when by paying an effective ount you are going to spend is $twenty-two,five hundred (not including Later Charges and you can Came back Take a look at Fees, if any). The utmost quantity of frequently planned payments you are going to build are 60. You would not spend more than 23% Apr. Zero fee is needed if for example the terrible obtained earnings is lower than $30,100 a year or if you eliminate your job and should not come across a job.

Investment You Quality-Situated, No-Cosigner Student loan

- Around $fifteen,one hundred thousand per educational year no cosigner required

- Fixed Prices (APR) out of 7.99% to help you % (plus an extra 0.5% dismiss to possess ACH vehicle-payments) *

- No origination fee. Zero late fee charge. No prepayment punishment.

- Small prequalification and rates check that would not impression their borrowing from the bank

This new student education loans away from $step three,001 around $fifteen,000 for each school year would-be supplied in order to citizens out of eligible says signed up due to the fact undergraduates inside the bachelor’s studies or comparable- granting apps during the eligible schools.

Resource You now offers fixed interest money, in the place of a beneficial cosigner, in order to youngsters who happen to be serious about the academic victory and you can post-grad field. Qualification relies upon several things, including: university graduation price, classification hours accomplished, estimated graduation date, informative list, major; a career or internship feel; and you can, other educational and non-informative issues that show the brand new debtor is actually spending so much time to your instructional and you can elite wants and that’s focused being pay financial obligation accumulated.

Qualification is even limited by condition out of long lasting household. Conditions and terms are very different by state. Only a few funds are available in every states. Loan numbers available may vary because of the state.

DISBURSEMENT All of the Mortgage continues might be taken to the pupil borrower’s school within the big date classes begin, with the big date the university prefers. Resource You requires papers to ensure your membership and you will certify the loan you want in advance of disbursement. Your own college or university must also certify your loan need. The loan ount out of you would like formal by the college or university.

Repayment Terminology The fresh Undergraduate loans into the 2021-2022 college seasons can get an annual percentage rate (APR) from 7.49% in order to %. All financing enjoys a fixed interest rate range of 7.49%* to % (in advance of attention off ACH write off). There’s no origination fee. Notice accrues if you find yourself children come into college or university.

In-university partial costs: Students get favor possibly $20 month-to-month since a good “Fixed Payment” when you are signed up for school otherwise “Focus Merely” payments. These types of costs was claimed so you can credit reporting agencies like other college student financing. Every finance provides a ten-seasons fees term (paid monthly more 120 weeks doing 6 months immediately following graduation). In both-College or university payment alternatives may possibly not be in every states. Student’s electing to make Attract-Merely money get a good 0.5% interest dismiss.

*A low rate found is present simply to juniors & elderly people that have a good educational results which can be maybe not normal of your own pricing offered to most consumers. Their genuine rate is dependent upon creditworthiness and other products, like your school seasons and you may GPA.

Certain condition fund none of them cosigners, although borrower must have decent credit scores. Small regional banking companies and you can borrowing unions none of them a great cosigner private otherwise unsecured loans. Secured finance, eg house guarantee loans and you can lines of credit, will do not require a great cosigner.

Mortgages and other secured finance involve a different sort of number of dangers than just student loans. For those who standard on property security financing otherwise HELOC, you can treat our home. For folks who standard to the a federal or personal education loan, the lending company try not to repossess your own education.

Children that are trying a personal education loan should consider casting a bigger web to own prospective cosigners, not simply mothers. Aunts, uncles, grand-parents, more mature sisters and other family relations could be permitted act as cosigners. However, these family members tends to be quicker forgiving versus student’s moms and dads in the event that new beginner non-payments to the loan and you will ruins the new cosigner’s borrowing. It will produce embarrassing vacation food.

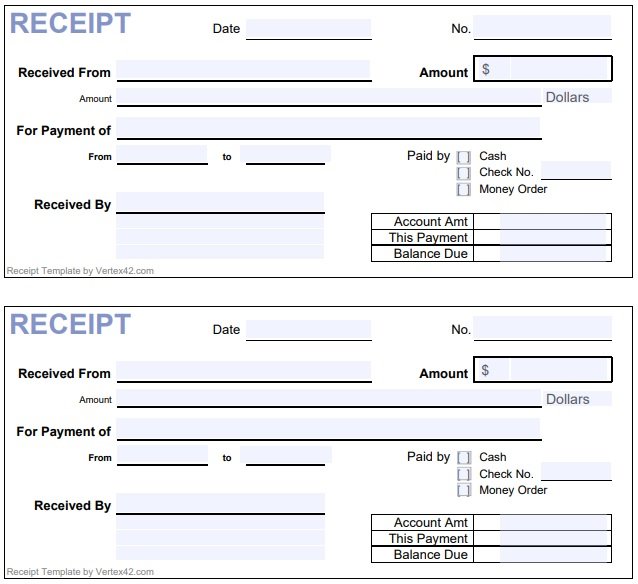

Alternately, loved ones that happen to be unwilling to cosign a personal education loan you will feel willing to borrow on the fresh student’s behalf themselves. The brand new relative can make the latest money on the mortgage, shielding the credit, in addition to scholar can make costs toward relative to safeguards brand new price of the mortgage money. This has been better to possess such as for instance a scenario memorialized into the an official authored contract such as for example that loan promissory mention to have the pupil make the payments into the relative’s loan. Or even, issues is develop about what nature of your assistance from the fresh new cousin.